Recently, two economists, Ricardo Perez-Truglia of Microsoft Research and Ugo Troiano of the University of Michigan at Ann Arbor, completed a study to find out the effectiveness of the ‘shaming penalty.’

The economists doing the study decided to select three states (Wisconsin, Kentucky, and Kansas) and mail out 35,000 letters of varying content to see which method produced the largest jump in repayment. Some letters only reminded the person of their delinquency while others letters said that their fellow delinquent neighbors would be informed as well.

The public shaming letters produced a 12% jump in repayment in the following 10 weeks after those people received them, however, that jump was only for the folks who were in the bottom quartile (less than $2700 owed.)

The folks that owed the larger amounts were not necessarily affected by the public shaming letters. The authors surmise that because the letters were only sent to fellow delinquent tax payers, it had less social stigma. They suggested that if the letters were sent to family, friends or business associates, the percentage of those that pay would increase.

What does this mean as a business owner?

The study concluded that the practice of ‘shaming penalties’ was effective in tax debt collection. They also showed that by utilizing different types of ‘shaming,’ like letters to fellow delinquent tax payers or possibly even to family, the state could increase the number of tax payments for every quartile.

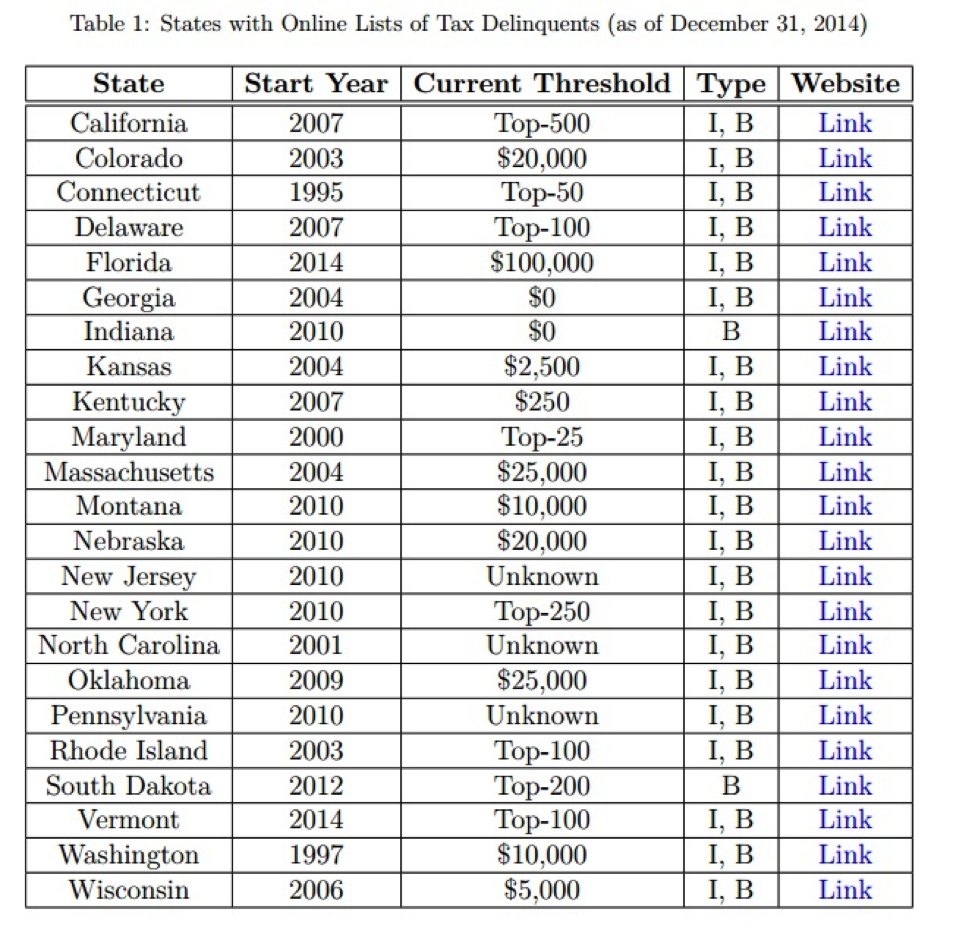

States will continue to join in this practice, with Vermont as the most recent. As we all know, states are broke, so it is also very likely that they will continue to strengthen their tactics to receive the money owed them. This means that if you, as a business owner, are behind in your taxes, your customers and your colleagues have the ability to see just how much.

Although it is not necessarily fair to have your private business available for public consumption, we don’t see the states reversing their policy anytime in the future. If you need help with or have questions about filing, we’re here to help.