Why cash flow matters

Cash flow management separates a good small-business owner from a great one. It’s definitely not as sexy as making a big sale or scoring a round of financing. But business owners who effectively manage their cash flow gain a notable advantage in the market and stay in business longer.

Esther Thompson, founder of TeaHuggers, has been using Xero to gain a better overview of her cash flow. “Having real-time financial data to manage your cashflow is so important,” Esther said. “At the end of the day, that’s the critical side of the business. If you’re not making money then the company’s not going to be viable.”

Cash is a valuable resource. Ensuring that a business has enough to meet its needs is vital to a company’s survival. Many functions of a business rely heavily on cash to operate. This includes paying staff and buying supplies. Most businesses start with just a small amount of cash. Then as revenues grow, funds are sufficient to cover bills. Problems may begin when entrepreneurs offer credit to customers, take on a loan, or hire an employee. Suddenly revenues don’t cover the business’ operating expenses.

“Before I started using Xero, I was just too busy to effectively manage cash flow and payroll. The wheels were coming off despite the fact that business was going well,” said Ryan Pinke. Ryan is the owner of Video Conference Gear. His company offers electronic, collaborative, digital signage and video conferencing solutions. “I got great advice and counseling from my Xero-certified accounting partners at Catching Clouds. Now my cash flow has never been stronger and I can focus on my customers around the globe.”

We know that the money in your business is important. We also know how hard it is to work on and in your business at the same time. We have two upcoming features that should help you get a handle on your cash, and even get paid faster. Billable Expenses and Invoice Reminders.

“I’ve become much closer to my business’ cash flow since we started using Xero. I’m able to quickly see the cash coming in or going out from the dashboard. It gives me an instant sense of how the business is running. Combined with my Insightly CRM and Gmail, I’m able to run my business on a sophisticated system that would have cost me tens of thousands of dollars a few years ago,” said Rohan Calvert, director of Sydney-based painting group Men in White.

Our research shows that businesses who use Xero get paid 30 days faster in 2014 than they were in 2011. That’s a massive step up in cash flow and productivity.

Time sensitive billable expenses

These are commonly referred to as billable expenses, on-charges or reimbursables. It means any cost you’ve paid for on behalf of your customers. This could be delivery costs, taxi charges or supply costs. Recovering these expenses from a customer, as quickly as possible, is key. Incorrectly tracking and billing back to clients means taking a loss to revenue and profits.

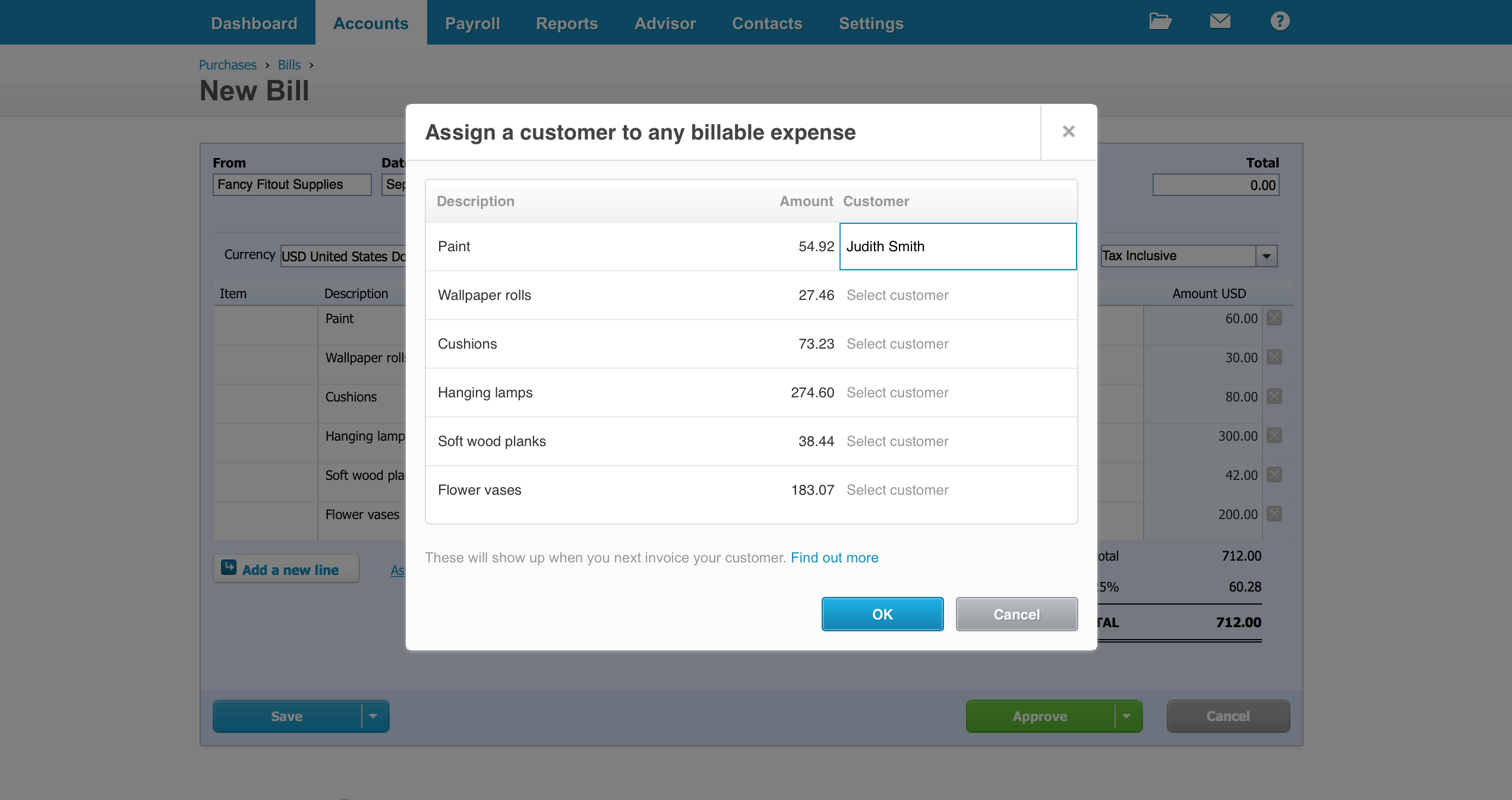

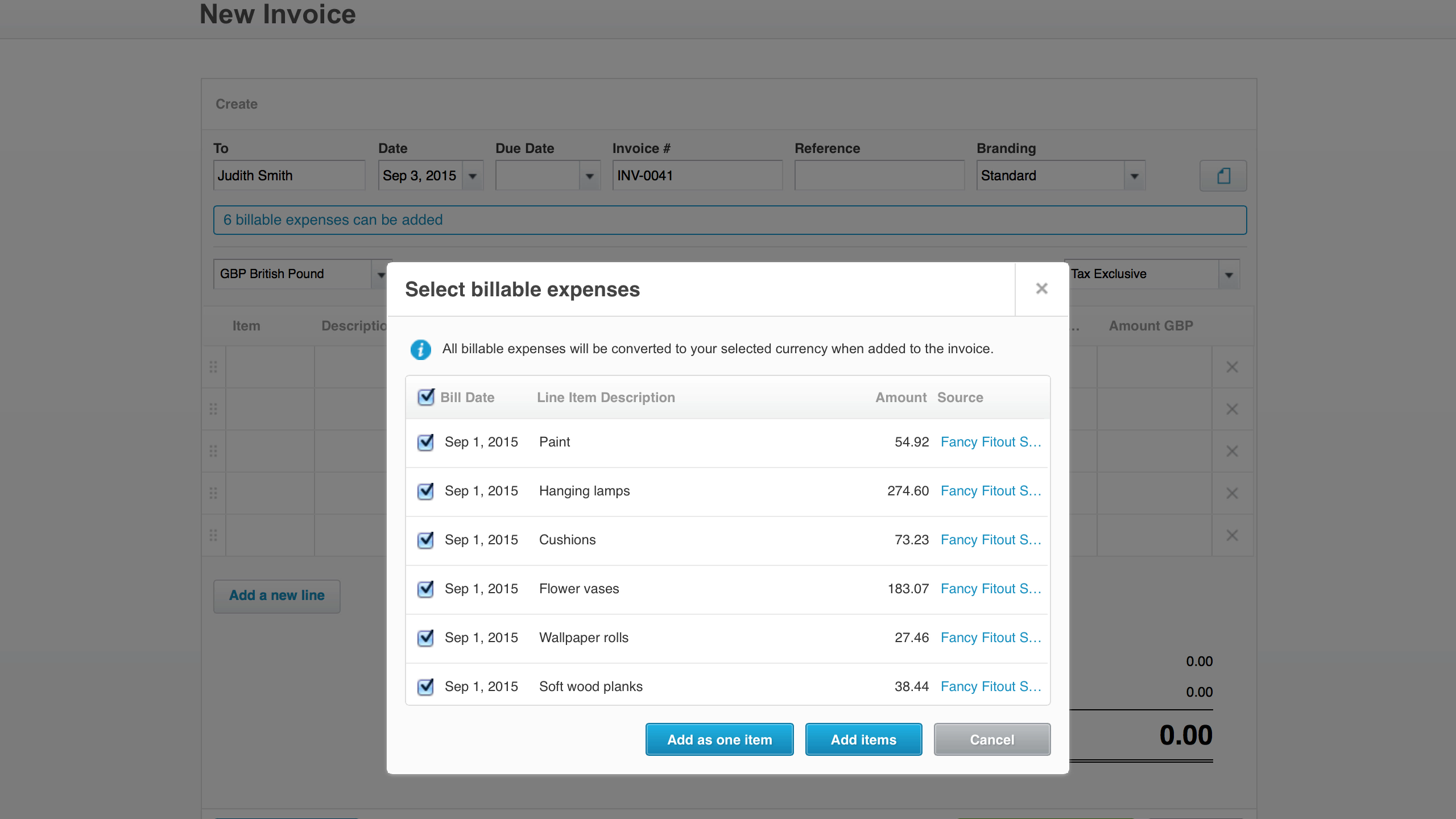

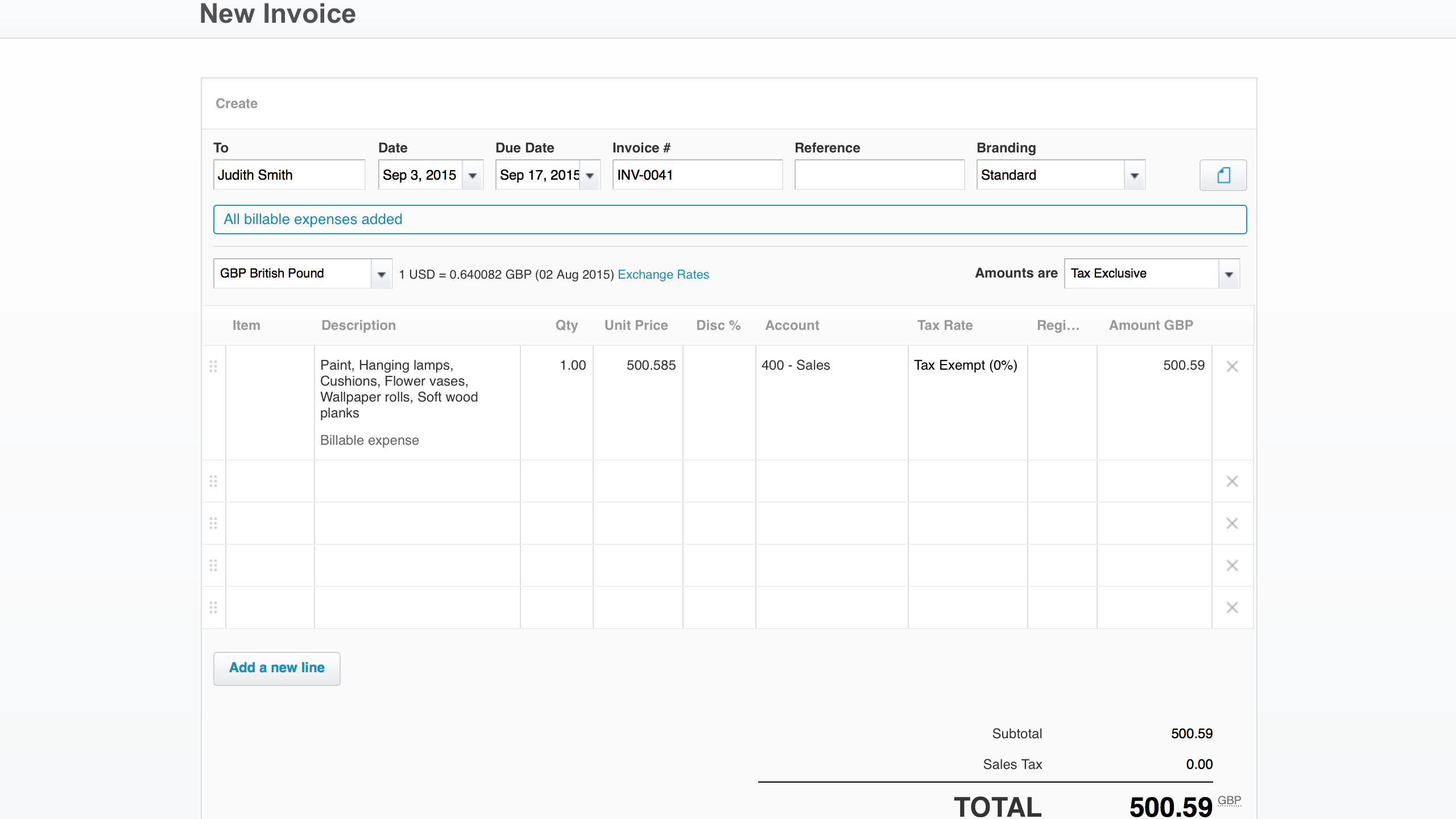

- Rather than stashing receipts in shoeboxes or using a spreadsheet to track costs, Xero’s Billable Expenses makes it easy. You can now mark a line item on a bill as a “billable expense”. You can then assign it to anyone in your contacts and Xero will remind you to add it to their next invoice.

- You can also easily track costs associated with a particular contact and recoup costs. This is critical for protecting profit margins and maintaining healthy cash flow.

Expensify

We know how important it is that you pass on the charges you accrue for clients. For the first time in Xero history we worked with our ecosystem on a feature before we released it to the public. We provided API support to our partners and Expensify was the first one to integrate our feature.

A huge benefit of Expensify is saving time and money through automation. Because of this, we were really excited work with them to give our mutual customers more time-saving functionality. Now, expenses marked as billable in Expensify are available for selection in Xero. From there you can quickly and easily generate sales invoices. Plus, invoices paid in Xero now automatically update the corresponding report in Expensify. These new features will really save users a ton of time.

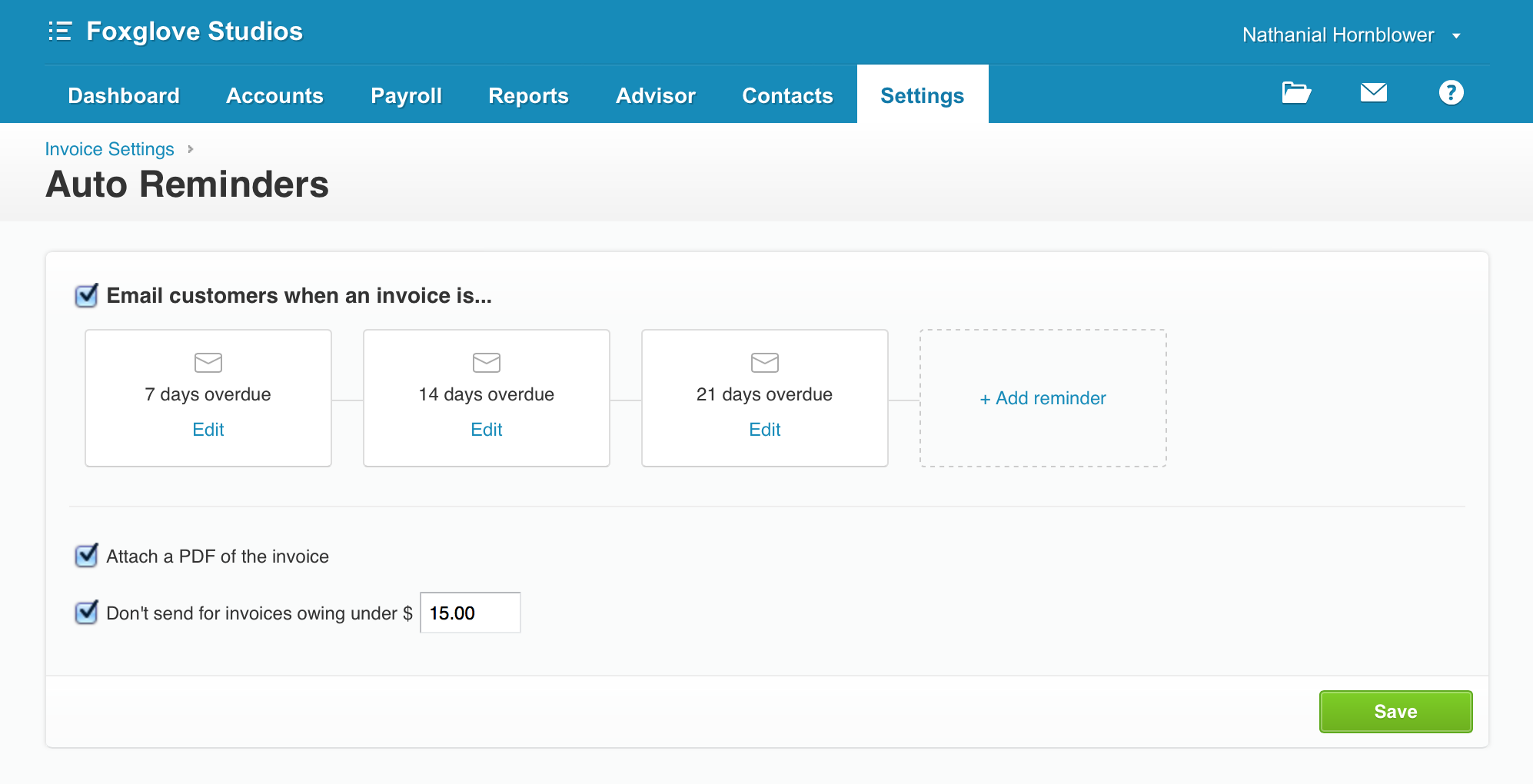

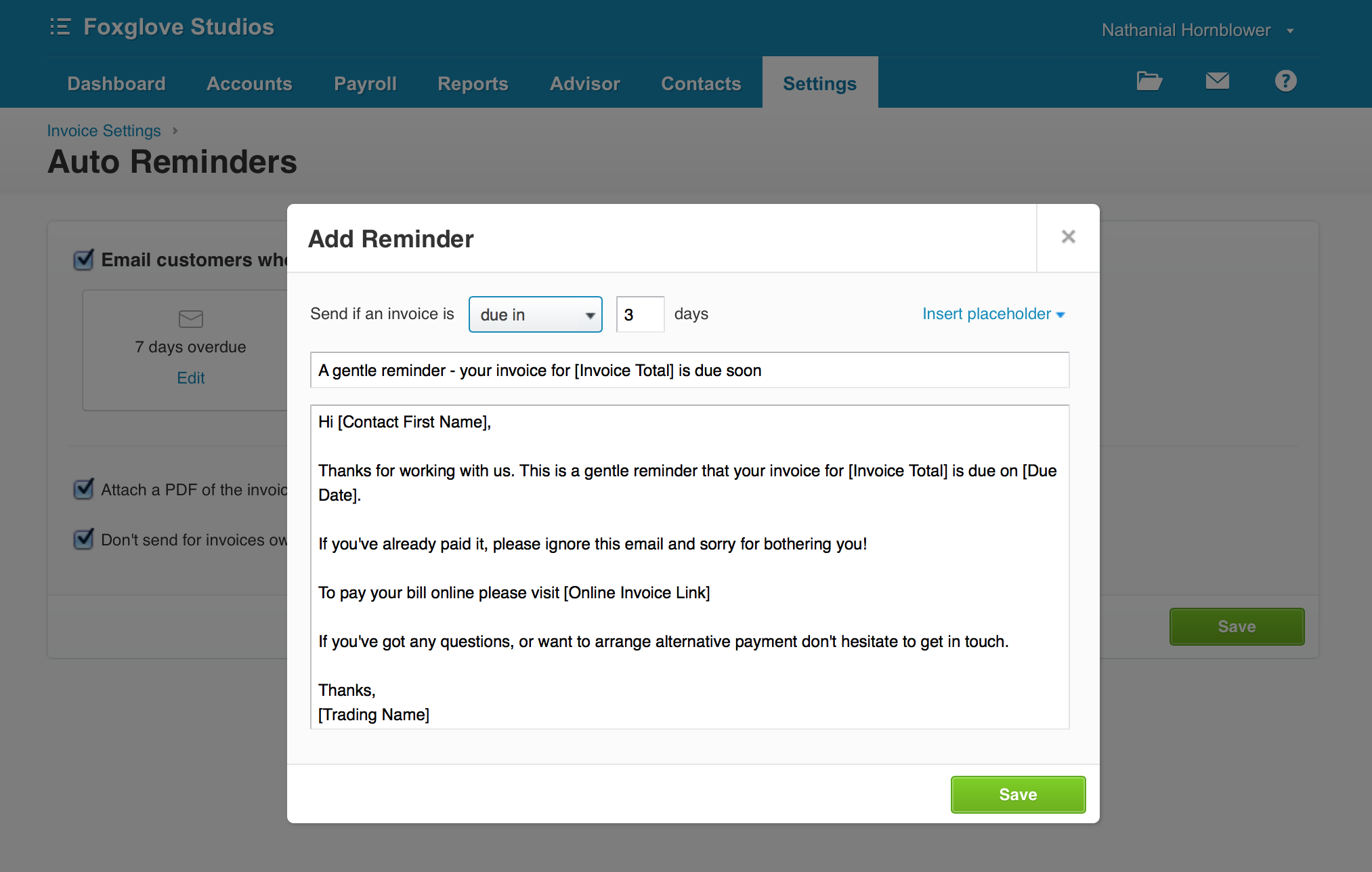

Invoice Reminders will help small businesses from being a bank

Outstanding invoices are a burden for any business – big or small. It’s not just the missing cash. We know the conversations around overdue invoices can be uncomfortable. Soon businesses will be able to automatically send clients an email reminder about their invoice. You will be able to remind them before or after it’s due, your choice. And the message is fully customizable. But once you get it set up, you don’t have to worry about it anymore. Xero’s new Invoice Reminders will launch in the coming months.